Permanent Residency in Malta – Ways to Obtain and Benefits

Introduction to Malta Permanent Residency

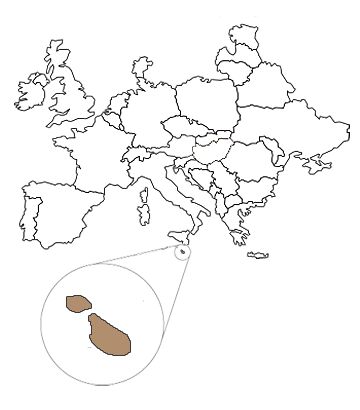

Malta, a beautiful island country in the Mediterranean, has become an increasingly popular destination for foreign nationals seeking permanent residency (PR). The country's favorable climate, high quality of life, and strategic location in Europe make it an ideal place to live, work, and invest.

If you are considering relocating to a European Union (EU) country, Malta permanent residency offers an excellent pathway to enjoy the benefits of EU membership. In this guide, we will cover the different ways to obtain Malta permanent residency, the eligibility requirements, the application process, and the many advantages it provides.

Types of Malta Permanent Residency Programs

Malta offers several routes to obtain permanent residency, with each option catering to different personal circumstances. The most popular routes include the Malta Permanent Residency Program (MPRP), investment-based residency, and the family reunification residency.

Malta Permanent Residency Program (MPRP)

The Malta Permanent Residency Program (MPRP) is one of the most well-known routes for obtaining PR in Malta. It was introduced to attract high-net-worth individuals and families to the island.

- Eligibility: To qualify for the MPRP, applicants must meet certain financial criteria, including making a contribution to the National Development and Social Fund, purchasing or renting property, and meeting other requirements for living in Malta.

- Process: The program requires applicants to submit documents such as proof of income, proof of accommodation, and a clean criminal record. The application must be submitted to the Malta Residency Visa Agency (MRVA).

- Advantages: Successful applicants receive a permanent residence permit that grants them the right to live, work, and travel within the EU. Malta also offers access to the Schengen Area, making it a convenient base for traveling across Europe.

Investment-Based Residency

Another popular route for obtaining permanent residency in Malta is through investment. Investors can qualify for residency by making significant financial contributions to the Maltese economy, such as through purchasing real estate or investing in government-approved projects.

- Eligibility: Applicants must meet specific investment criteria, including a property purchase or rental, a financial investment in Malta, and a contribution to local government funds.

- Process: The applicant will need to demonstrate the source of their investment funds, undergo due diligence checks, and submit documents like proof of identity, income, and investment.

- Advantages: Investment-based residency offers the opportunity to live in one of the most attractive EU countries while benefiting from Malta's favorable tax regime and business opportunities.

Family Reunification

The family reunification route allows individuals who already hold Malta permanent residency to bring their immediate family members to Malta. This includes spouses, children, and other dependents.

- Eligibility: The primary applicant must hold a valid Malta residence permit, and the family members must provide proof of relationship (e.g., marriage certificate or birth certificates).

- Process: The primary applicant applies for family reunification on behalf of their family members, submitting supporting documents.

- Advantages: Family reunification ensures that families can live together in Malta, offering them the same benefits and rights as the primary applicant.

How to Apply for Malta Permanent Residency

Obtaining permanent residency in Malta involves several steps, and the process can be complex depending on the type of residency you are applying for. Below is a general overview of the process:

Step 1: Determine Your Eligibility

Before you start the application process, you must determine which route for Malta permanent residency best suits your situation. Whether you are applying through investment, the Malta Permanent Residency Program (MPRP), or family reunification, you must meet the necessary eligibility criteria.

Step 2: Prepare Required Documentation

Once you have chosen your residency program, gather the required documents, which may include:

- Valid passport

- Proof of financial means (bank statements or proof of income)

- Proof of accommodation (property ownership or rental contract)

- Health insurance

- Proof of relationship (for family reunification)

- Investment documentation (for investment-based residency)

Ensure that all documents are in English or Maltese and officially translated, if necessary.

Step 3: Submit Your Application

Applications for Malta permanent residency must be submitted to the Malta Residency Visa Agency (MRVA). Depending on your chosen route, you will submit the required documents along with the application forms. If applying for investment-based residency, you may also need to work with a licensed agent to facilitate the process.

Step 4: Due Diligence and Background Checks

As part of the application process, authorities will conduct due diligence and background checks to ensure the legitimacy of your application. This includes criminal record checks and verification of financial sources.

Step 5: Wait for Approval

Once you have submitted your application and undergone the necessary checks, you will wait for approval. The processing time can vary but typically takes several months. Applicants are notified once their application has been approved, and they can proceed to the next step.

Step 6: Receive Your Permanent Residency Permit

If your application is approved, you will receive your Malta permanent residency permit, which allows you to reside, work, and travel freely within the Schengen Area. Depending on your residency route, your permit may be subject to periodic renewals or ongoing residency requirements.

Benefits of Malta Permanent Residency

Malta offers a range of benefits to permanent residents, making it an attractive destination for foreigners looking to relocate. Some of the key advantages of Malta permanent residency include:

1. High Quality of Life

Malta is known for its Mediterranean climate, beautiful landscapes, and rich history. The country offers excellent healthcare, a strong education system, and a low crime rate. It is an ideal destination for families, retirees, and professionals.

2. Access to the European Union

As a Malta permanent resident, you gain access to all the benefits of the European Union, including the freedom to travel, work, and live in other EU countries. This is a significant advantage for anyone looking to explore opportunities across Europe.

3. Business Opportunities

Malta offers a favorable business environment with low taxes, a highly skilled workforce, and a robust infrastructure. Entrepreneurs and investors will find opportunities in industries such as finance, technology, tourism, and real estate.

4. Tax Benefits

Malta is known for its attractive tax system, which offers incentives for foreign investors and entrepreneurs. Malta’s tax regime includes personal income tax benefits, corporate tax exemptions, and a network of double taxation treaties with numerous countries.

5. Stable Economy

Malta has one of the most stable economies in the EU, with strong growth in key sectors. It is part of the Eurozone, which provides stability and benefits for those holding permanent residency in the country.

6. Pathway to Citizenship

After holding permanent residency in Malta for a certain number of years, individuals may be eligible to apply for Malta citizenship through naturalization, subject to meeting language, residence, and integration requirements.

Conclusion: Why Choose Malta Permanent Residency?

A Malta permanent residency offers numerous advantages, including access to the European Union, a high quality of life, attractive tax benefits, and stable business opportunities. Whether you are looking to retire, invest, or work in one of Europe’s most dynamic countries, Malta offers an ideal destination for foreign nationals.

If you are considering applying for Malta permanent residency, start the process today to enjoy the benefits of living in this beautiful Mediterranean paradise.

Begin Your Malta Permanent Residency Application Today

Are you ready to make Malta your home? Contact us to get expert assistance with your Malta permanent residency application. We will guide you through the process and help you achieve your dream of living in one of Europe’s most sought-after destinations.

Legal framework for permanent residence in Malta: