UAE Residence Permit – Residence Permit, Ways to Obtain, and Benefits

Introduction to UAE Residence Permit

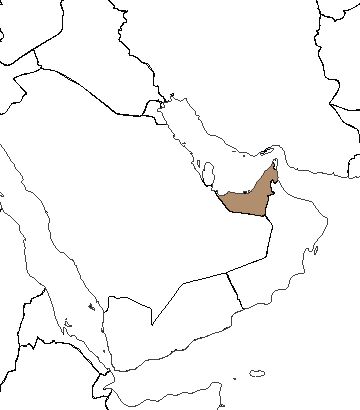

The United Arab Emirates (UAE) is one of the most sought-after destinations for expatriates and investors seeking a stable, prosperous, and secure place to live and work. With its cosmopolitan lifestyle, favorable tax policies, and strategic location in the heart of the Middle East, the UAE has become a global hub for business and tourism. Obtaining a UAE residence permit allows individuals to enjoy various benefits, including long-term residence in one of the world’s most dynamic and modern nations.

This guide will cover the ways to obtain a UAE residence permit, the eligibility criteria, and the significant advantages of becoming a resident of the UAE.

Why Choose the UAE for a Residence Permit?

1. Economic Opportunities and Business-Friendly Environment

The UAE is known for its business-friendly environment, with a thriving economy driven by sectors such as finance, tourism, real estate, and technology. The country is home to some of the world’s largest companies, and foreign investors are encouraged to establish businesses in the UAE through various incentives, including tax exemptions and 100% ownership in certain sectors.

- Free Trade Zones: The UAE has numerous free zones that offer tax incentives, full ownership for foreign investors, and other business advantages.

- Strategic Location: The UAE’s location between Asia, Europe, and Africa provides access to international markets, making it an ideal base for businesses and entrepreneurs.

2. Tax-Free Income and Wealth Management

One of the most significant advantages of obtaining a UAE residence permit is the country’s tax-free income policy. The UAE does not impose personal income tax, making it an attractive location for high-net-worth individuals, entrepreneurs, and employees who want to retain more of their earnings.

- No income tax: Residents can enjoy high salaries without the burden of income tax, which is one of the major reasons for the UAE’s popularity among expatriates.

- Wealth management: The UAE offers excellent wealth management and investment opportunities, with a range of international banks and financial institutions offering services tailored to the needs of investors.

3. World-Class Infrastructure and Quality of Life

The UAE is known for its modern infrastructure, world-class healthcare, and high standard of living. Cities like Dubai and Abu Dhabi are recognized for their skyscrapers, shopping malls, luxurious hotels, and excellent public services, making it an ideal place for those seeking a high-quality lifestyle.

- Healthcare: The UAE offers high-quality healthcare facilities with state-of-the-art hospitals and medical professionals, many of whom are internationally trained.

- Education: The UAE is home to numerous international schools and universities, providing educational opportunities for children and young adults.

4. Access to a Multicultural Society

The UAE is a melting pot of cultures, attracting people from all over the world. Living in the UAE offers the opportunity to engage with a multicultural society, where diverse traditions, cuisines, and lifestyles are embraced.

- Cultural diversity: The UAE is home to expatriates from various countries, creating a vibrant, diverse atmosphere in cities like Dubai, Abu Dhabi, and Sharjah.

- International community: Expats in the UAE can connect with people from all corners of the globe, creating a truly global experience for residents.

Ways to Obtain a UAE Residence Permit

The UAE residence permit is granted through several avenues, each catering to different types of individuals, including investors, employees, and entrepreneurs.

1. Employment Visa

The most common way to obtain a UAE residence permit is through employment. If you have a job offer from a company based in the UAE, you can apply for an employment visa. This visa is typically issued for 2-3 years and is renewable, provided you continue your employment with the sponsoring company.

- Eligibility: You need a job offer from a UAE-based employer, and the employer must apply for the visa on your behalf.

- Required Documents: A valid work contract, medical examination, and proof of qualifications.

2. Investor Visa

If you are an investor or entrepreneur planning to start a business or invest in the UAE, you can apply for an investor visa. This type of visa is issued to individuals who have a stake in a UAE company, and it allows the holder to live and work in the UAE.

- Eligibility: You must invest a specified amount in a UAE business or own a company that meets the investment threshold.

- Required Documents: Proof of investment, business ownership documents, and other financial records.

3. Golden Visa

The UAE has introduced a special Golden Visa program for investors, entrepreneurs, skilled professionals, and exceptional talents. This long-term residency visa offers 10 years of residence and can be renewed. It is available to individuals who meet specific criteria set by the UAE government.

- Eligibility: Individuals who make substantial investments in the UAE, such as owning real estate or contributing to sectors like healthcare, education, and technology.

- Required Documents: Investment proof, business or talent-related credentials, and other supporting documents.

4. Family Visa

If you are a UAE resident, you can sponsor your immediate family members, such as your spouse, children, and parents, to live in the UAE through a family visa. The sponsor must meet specific income requirements to qualify for family sponsorship.

- Eligibility: You must be a UAE resident earning a minimum monthly income and meeting other criteria.

- Required Documents: Proof of relationship (marriage certificate, birth certificates), income proof, and health insurance for dependents.

5. Student Visa

Students enrolled in a UAE-based educational institution can apply for a student visa, which allows them to reside in the UAE for the duration of their studies. This visa typically requires the student to demonstrate that they have sufficient funds to support themselves during their education.

- Eligibility: Proof of enrollment in a UAE university or educational institution.

- Required Documents: Admission letter, proof of funds, and medical insurance.

Benefits of Obtaining a UAE Residence Permit

1. Tax-Free Income

One of the biggest advantages of obtaining a UAE residence permit is the tax-free income. The UAE is known for its tax-friendly policies, particularly when it comes to personal income tax. This makes it an attractive destination for high-earning professionals and business owners.

- No personal income tax: Residents can enjoy salaries without being taxed on income, which is a significant advantage over other countries with high income tax rates.

2. Access to World-Class Healthcare

The UAE offers access to some of the world’s best healthcare services, including advanced medical technology, specialized treatments, and highly trained medical professionals.

- Universal healthcare access: Residents can benefit from top-quality healthcare facilities in the country, providing peace of mind for individuals and their families.

3. Real Estate Ownership

With a UAE residence permit, investors and entrepreneurs may be eligible to own property in certain areas of the country. The UAE offers a range of residential and commercial real estate opportunities, including luxury apartments, villas, and commercial properties.

- Real estate investment: Real estate is a popular investment vehicle in the UAE, with high potential returns, especially in cities like Dubai and Abu Dhabi.

4. Access to Education

Residents of the UAE have access to high-quality education, both in public and private institutions. There are numerous international schools and universities in the UAE, offering curricula in multiple languages, including English, French, and Arabic.

- International education: The UAE has many world-class educational institutions offering opportunities for higher education in a globalized setting.

5. Lifestyle and Luxury

The UAE offers a luxurious lifestyle with world-class amenities, entertainment options, shopping malls, and recreational facilities. The country is home to the world’s tallest buildings, largest shopping malls, and most extravagant hotels.

- Luxury living: From fine dining to luxury shopping, residents can enjoy a lifestyle that is unmatched by most other countries.

Conclusion: Why Obtain a UAE Residence Permit?

The UAE residence permit offers numerous advantages, including a tax-free income, access to world-class healthcare and education, and the opportunity to live in one of the most modern and prosperous countries in the world. Whether you are an entrepreneur, an investor, a professional, or a student, the UAE offers a range of opportunities for those looking to live and work in a global hub.

Apply for Your UAE Residence Permit Today

Are you ready to obtain your UAE residence permit? Contact us today to learn more about the application process and how we can help you secure your residence in the UAE. Our team of experts is here to guide you through every step of the process.